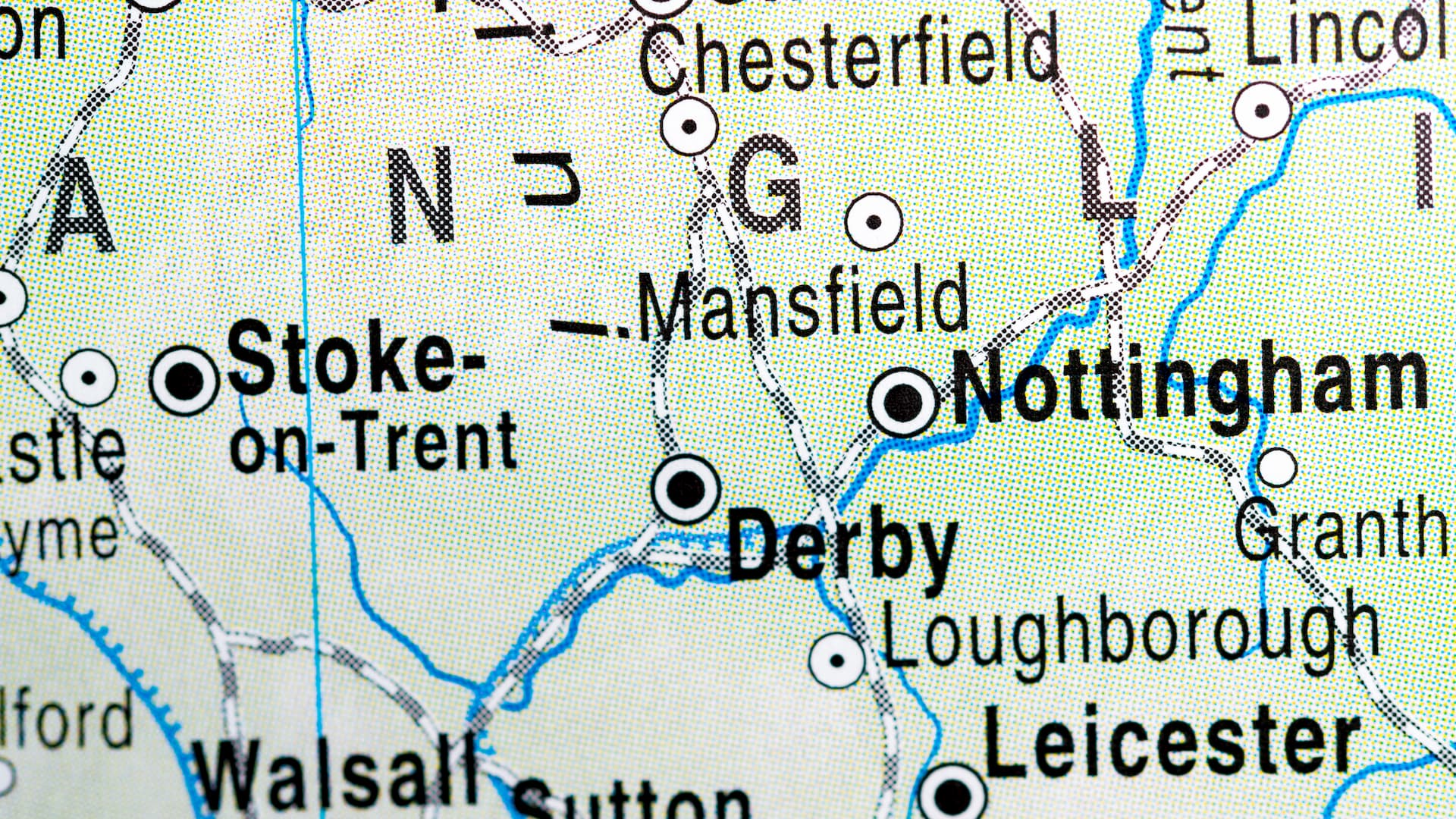

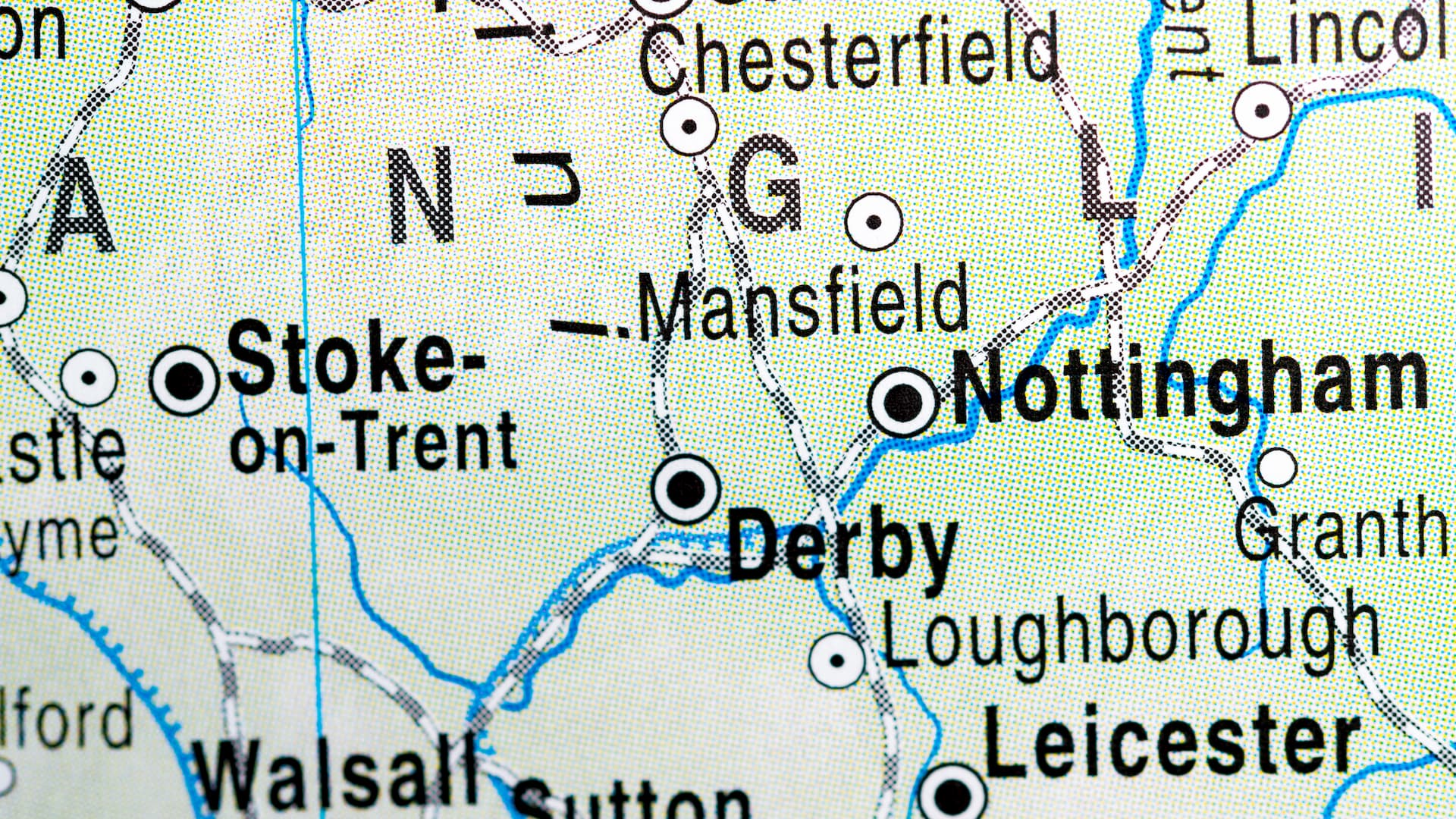

BTL landlords in East Midlands most optimistic

Buy-to-Let (BTL) landlords operating and renting out properties in the Private Rental Sector (PRS) in the East Midlands are the most optimistic in the UK. A new survey shows that rental yields in the region were the joint highest, while expectations for future yields were also positive. This goes to show that although there is some concern among landlords about the heavy regulatory burden they now carry, a good income can still be achieved.

However, landlords who want to achieve the best possible yield from their BTL investment while also securing the potential to make some capital gains, rarely do so without hard work, research and solid market awareness.

East Midlands BTL landlords most optimistic

Research from the BVA BDRC shows that, thanks to a combination of annual rental yields and capital gains expectations for property prices, landlords invested in BTL in the East Midlands were the most optimistic in the third quarter of 2019.

Some 50% of landlords in that region were upbeat over the outlook for rental yields. That followed on from an average yield of 6.1% between July and September, which was the joint highest during that period. In addition to that, landlords in the East Midlands were the most positive on the outlook for capital gains – 31% of landlords invested in property in the East Midlands said they were optimistic over the prospect of their properties rising in value.

The next most optimistic regions based on rental yield expectations were:

- Yorkshire and Humber

- South West England

Looking at capital gains expectations, the next two most optimistic regions were:

- Central London

- East of England

However, at the other end of the scale, the three least optimistic regions in terms of rental yields expectations in the third quarter were:

- Wales

- North East England

- Central London

The most pessimistic areas with regards to capital gains expectations were:

- North East England

- Wales

- Yorkshire and Humber

Indeed, just 16% of landlords in Yorkshire and Humber said they were optimistic about capital gains of their investment properties in that region.

The survey highlights that right now, the East Midlands has found a good balance between rental demand, how much investment is required to supply the market and also, room for property prices to rise further. These are three important elements when it comes to being a PRS BTL landlord in the UK.

However, even though there are some positive details for landlords to consider, separate research shows that the regulatory burden that landlords now have to deal with is around one third higher than it was in 2010.

UK BTL landlords under more regulatory scrutiny

According to analysis by the Residential Landlords Association, (RLA) UK BTL landlords now face 32% more regulatory obligations than they did nine years ago in 2010. Specifically, there are now a total of 156 regulations affecting BTL landlords, up from 118 when the Conservative-led, coalition Government came to power.

The RLA believes that while some of the new regulations have proved beneficial, the introduction of further rules would likely prove ill-advised. Instead, they would prefer to see the improvement of enforcement of existing powers to manage and monitor landlords, to improve the industry for both investors and tenants.

“Piling more regulations onto the sector which will continue not to be properly enforced is meaningless and serves only to put off good landlords from providing the homes to rent we need,” said the RLA’s policy director, David Smith. “It is time for smarter enforcement, not more regulation.”

But its not just the Government who can work smarter in the PRS rental industry, landlords and letting agents can too. By using some of the emerging property services, such as RentGuarantor.com which provides tenants with a digital rent guarantor, guaranteeing rent payments without the need to involve family members or close friends, landlords can gain peace of mind that their rent will always be paid, no matter what befalls their tenants.

By using new approaches to manage your BTL portfolio, landlords can remain part of the growing need for rental accommodation across the UK while also ensuring their investment is profitable and worthwhile.