Rental deposit rise dwarfed by other costs

While its common to read and hear about how expensive renting is in the UK and that its set to get more expensive in the future, it's less usual to hear that rental costs rises aren't as high as they could be. However, recent research has highlighted that even though rental costs have risen, the increase in rental deposits is much lower than price rises of other costs faced by many Britons.

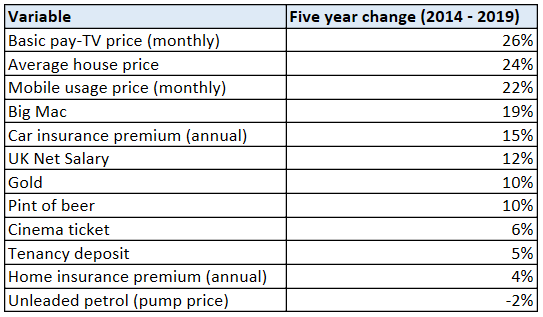

According to analysis undertaken by Hamilton Fraser’s rental deposit scheme arm, Ome, rental deposits in the UK have risen by an average of just 5% to £1,139 from £1,088 in 2014. While that still represents a major outlay for tenants, the rate at which deposits have increased is much lower than many other home-related costs faced by tenants and home-owners.

Tenants hit by various home-related price rises

While that 5% rise in rental deposits certainly plays a part in the ongoing rising expense of renting a home in the UK, there are other costs, some related with renting or owning a home, that have also risen over the same period and by much more.

The largest price increase of 26% was recorded in the price of basic TV packages from providers including Sky and Virgin. That rise saw the average monthly cost of a basic TV package rise from £22 to £28.

The average monthly cost of running a mobile phone, meanwhile, has risen by 22%, while the price of a Big Mac is now 19% higher than it was in 2014!

Other costs that have risen by more than rental deposits include:

- Car insurance.

- UK salaries.

- Gold.

- The price of beer.

- Cinema tickets.

“The rental sector has received a fair share of negative press in its time and much of this has been focussed around the traditional deposit and the sums charged by agents at the start of a tenancy in order for a tenant to secure a property,” said co-founder of Ome, Matthew Hooker.

“It would seem that it is the cost of living within a property itself that is putting the greatest financial squeeze on the nation’s tenants, with the actual deposit only proving a problem for those unable to accumulate the large initial sum, or finding themselves short for other areas of life once they have, “ he added.

Costs that have risen by less than deposits

While it’s interesting to discover the range of items have risen by a greater proportion than tenancy deposits, it’s also important to remember that there are also some costs which have risen by less, or even declined during the same period. The researched picked out two items that have done so:

- Annual home insurance premiums.

- The price of unleaded petrol.

The following table shows the full list of price changes of selected goods and services identified by Ome:

Source: Ome

However, while its clear that numerous items have risen by more than rental deposits, the sheer size of rental deposits for many tenants would still be an issue even if the average price had fallen during the period used in the research.

“Of course, many of these other costs are either small or provide the option to pay in instalments with the deposit being the last major cost that can’t be widely tackled in bite sized chunks,” Hooker said. “That’s why we’ve seen a number of deposit alternatives enter the market in order to provide this choice and allow tenants to stay on top of the climbing costs elsewhere in life, by opting to pay their rental deposit on a more manageable monthly basis.”